Drilling in the Alaskan Arctic National Wildlife Reserve vs. Renewable Energy: The Drilling Debate, Economic and Environmental Effects, and How Solar and Wind Energy Investment Would Compare

In a first for this blog, the focus of this post comes directly from a reader request– so I’ll let this person’s words speak for themselves:

With Congress recently passing a bill allowing for drilling of oil and gas in Alaska’s Arctic National Wildlife Refuge (ANWR), it got me curious (as a citizen of the sun-rich American Southwest) how much land would need to be covered in solar panels in order to generate the same amount of energy that would be found in these potential new oil and gas drilling sites. Obviously each energy source would have their individual costs to consider, but I am curious as to how efficient and cost-effective it would be to drill in the Alaskan arctic if there are cleaner and cheaper alternatives– it seems covering up the deserts of New Mexico and Arizona could be preferable to potentially harming some of the Alaskan environment and wildlife. Is drilling in this new area even an efficient and safe way for us to get additional oil and gas?

– Case

I loved the thoughtfulness and importance of this question and was inspired to immediately jump into research (also I was so happy to have a suggestion from an outside perspective– so if you read this or any of my other posts and you get inspired or curious, please do reach out to me!). From my perspective, this overall inquiry can be broken down into five questions to be answered individually:

What is ANWR and what exactly did Congress authorize with regards to drilling in ANWR?

How much potential oil and gas would be produced from the drilling?

What are the economics associated with extracting and using oil and gas from ANWR?

What are the environmental effects of that drilling?

Can we do better to just install renewable energy resources instead of drilling in ANWR? How much capacity in renewable sources would be needed? How would the costs of renewable installations compare with the ANWR drilling?

Question 1: What is ANWR and what exactly did Congress authorize with regards to drilling in ANWR?

The Arctic National Wildlife Refuge, or ANWR, has long been a flash point topic of debate, viewed by proponents of oil and gas drilling as a key waiting to unlock fuel and energy independence in the United States, while opponents argue that such drilling unnecessarily threatens the habitat of hundreds of species of wildlife and the pristine environment that’s been protected for decades. ANWR is a 19.6-million-acre section of northeastern Alaska, long considered one of the most pristine and preserved nature refuges in the United States. Having stayed untouched for so long has allowed the native population of polar bears, caribou, moose, wolverines, and more to flourish. ANWR was only able to remain pristine due to oil and gas drilling in the refuge being banned in 1980 by the Alaskan National Interest Conservation Act, with Section 1002 of that act deferring decision on the management of oil and gas exploration on a 1.5-million-acre coastal plane area of ANWR known to have the greatest potential for fossil fuels. This stretch of ANWR has since become known as the ‘1002 Area.’

Source: USGS

This 1002 Area of ANWR is at the center of the ANWR debate, as Presidents and Congresses have had to fight various bills over the past couple decades that sought to lift those drilling bans, doing so successfully until recently. At the end of 2017, with Republicans (who have long been pushing to allow such oil and gas exploration in ANWR) controlling the White House and both Houses of Congress, decisive action was finally made. The Senate Energy and Natural Resources Committee, led by Lisa Murkowski of Alaska, voted in November to approve a bill that would allow oil and gas exploration, with that bill ultimately getting attached to and approved along with the Senate’s tax-reform package in December, with the justification for that attachment being that the drilling would help pay for the proposed tax cuts.

Specifically, the legislation that ended the ban on oil and gas drilling in ANWR did so by mandating two lease sales (of at least 400,000 acres each) in the 1002 Area over the next 10 years. The government’s royalties on these leases are expected to generate over $2 billion, half of which would go to Alaska and the other half to the federal government.

Source: News Deeply

Question 2: How much potential oil and gas would be produced from the drilling?

This really is the million dollar (or, rather, billion dollar) question, because part of the issue is that no one really knows how much fossil fuel is hidden deep under ANWR. The situation is a bit of a catch-22, as you cannot get a good idea for how much oil there is without drilling, but under the drilling ban you cannot explore how much there is. A number of surface geology and seismic exploration surveys have been conducted, and the one exploratory drilling project by oil companies was allowed in the mid-1980s, but the results of that study remain a heavily guarded secret to this day (although National Geographic has previously reported that the results of the test were disappointing). In contrast even to regions bordering ANWR in Alaska that have the benefit of exploratory drilling, any analysis of the 1002 Area is restricted to field studies, well data, and analysis of seismic data.

The publicly available estimates from the 1998 U.S. Geological Survey (USGS) (the most recent one done on the 1002 Area) indicate there are between 4.3 billion and 11.8 billion barrels of technically recoverable crude oil products and between 3.48 and 10.02 trillion cubic feet (TCF) of technically recoverable natural gas in the coastal plain of ANWR. Even though there is that much oil and gas that is technically recoverable, though, does not mean that all of it would be economical to recover. A 2008 report by the Department of Energy (DOE), based on the 1998 USGS survey and acknowledging the uncertainty in the USGS numbers given that the technology for the USGS survey is now outdated, estimates that development of the 1002 Area would actually result in 1.9 to 4.3 billion barrels of crude oil extracted over a 13-year period (while the rest of the oil would not be cost effective to extract). The report also estimates that peak oil production would range from 510,000 barrels per day (b/d) to 1.45 million b/d. These estimates must be taken with a grain of salt, however, as not only are they based on the use of now-outdated technology, but the technology to extract oil is also greatly improved. These technology improvements mean the USGS estimates could be low, but on the other side, oil exploration is always a lottery and recent exploration near ANWR has been disappointing. That’s all to say, current estimate are just that, estimates– which makes the weighing of pros and cons of drilling all the more complicated.

Source: National Geographic

The 2008 DOE report did not assess the potential extraction of natural gas reserves (note that much of the analysis and debate surrounding ANWR drilling focuses mainly on the oil reserves and not the natural gas reserves, likely because the oil is more valuable, cost-effective to extract, and in demand. Where relevant, I will include the facts and figures of natural gas in addition to the oil, but note that certain parts of this analysis will have to center just on the oil based the the availability of data).

To put that in context, the total U.S. proved crude oil reserves at the end of 2015 were 35.2 billion barrels, so the technically recoverable oil in the 1002 Area would account for 12 to 34% of total U.S. oil reserves. At the end of 2015 the U.S. proved reserves of natural gaswere 324.3 TCF, making the technically recoverable natural gas in the 1002 Area equal to 1 to 3% of total U.S. natural gas reserves. Put another way, the the technically recoverable oil reserves would equal 218 to 599 days worth of U.S. oil consumption (using the 2016 daily average), while the natural gas reserves would equal 47 to 134 days worth of U.S. natural gas consumption (using the 2016 daily average).

Question 3: What are the economics associated with extracting and using oil and gas from ANWR?

In addition to the push towards ‘energy independence’ (i.e., minimizing the need for oil imports from foreign nations where prices and availability can be volatile), a main motivation for drilling in the 1002 Area of ANWR is the economic benefits it could bring. In addition to the $1 billion for the Alaskan government and $1 billion for the federal governmentfrom the leasing of the land, Senator Murkowski boasted that the eventual oil and gas production would bring in more than $100 billion for the federal treasury through federal royalties on the oil extracted from the land.

Source: Gray TV Inc

However, these theorized economic benefits to drilling is strongly disputed by the plan’s opponents, with president of the Wilderness Society noting that ‘the whole notion that you are going to trim a trillion-dollar deficit with phony oil revenue is just a cynical political ploy.’ When digging into the numbers more closely, the $1 billion to the federal government from leasing the land would end up offsetting less than 0.1% of the $1.5 trillion in tax cuts to which the drilling provision was attached (while some analyses question whether the land would gather that much in reality, noting the estimates assume oil leases selling for 10 times what they sold for a year ago when domestic oil was scarcer and more expensive).

Outside of the federal revenue, the money coming to the Alaskan government would be even more influential, which is why the charge to open ANWR to drilling is often led by Alaskan policymakers. In fact, while a majority of Americans oppose drilling in ANWR, most Alaskans are cited as supporting responsible oil exploration. While that may seem counterintuitive, the Arctic Slope Regional Corporation explains that “a clear majority of the North Slope support responsible development in ANWR; they should have the same rights to economic self-determination as people in the rest of the United States.

In addition to the money raised by the government is the potential economic benefit to the country from the extraction of the oil. According to the previously mentioned 2008 DOE report, the extraction of the ANWR oil would reduce the need for the United States to import $135 to $327 billion of oil. This shift would have a positive benefit to the U.S. balance of trade by that same amount, but the reduction of reliance on imported foreign oil would only drop from 54% to 49%, and the effect on global oil prices would be small enough to be neutralized by modest collective action by the Organization of Petroleum Exporting Countries (OPEC), meaning U.S. consumers would likely not see an effect on their energy prices.

The last economic consideration would be the worth of the oil and the cost to the companies doing the drilling to extract and bring to market the oil products. A study done by the researchers at Elsevier found that the worth of the oil in the 1002 Area of ANWR is $374 billion, while the cost to extract and bring to market would be $123 billion. The difference, $251 billion, would be the profits to the companies— which theoretically would generate social/economic benefits through means such as industry rents, tax revenues, and jobs created and sustained.

So in short, the decision about whether or not to drill in ANWR has the potential to cause a significant economic effect for the federal and Alaskan state governments, the oil companies who win the leasing auctions, and those who might be directly impacted from increased profits to the oil and gas companies. As with all analytical aspects of ANWR drilling, though, the exact scale of that effect is hotly debated and subject to the great uncertainty surrounding how much oil and gas are technically recoverable from the 1002 Area. Further, the amount of oil that is economically sound to recover and put into the market (not to mention the price oil and gas companies would be willing to spend on leasing this land) is entirely depending on the ever-fluctuating and difficult to forecast price of crude oil, adding further potential variability to the estimates.

Question 4: What are the environmental effects of that drilling?

As previously noted, drilling in ANWR is an especially sensitive environmental subject because it is one of the very few places left on Earth that remains pristine and untouched by humanity’s polluted fingerprint. The vast and beautiful land has been described by National Geographic as ‘primordial wilderness that stretches from spruce forests in the south, over the jagged Brooks Range, onto gently sloping wetlands that flow into the ice-curdled Beaufort Sea’ and is often called ‘America’s Serengeti.’ In terms of wildlife, ANWR is noted as fertile ground for its dozens of species of land and marine mammals (notably caribou and polar bears) and hundreds of species of migratory birds from six continents and each of the 48 contiguous United States.

Source: News Deeply

While the exact environmental effects of oil exploration and drilling are not known for certain, the potential ills that can befall the environment and wildlife in ANWR include the following:

Oil development is found to be very disruptive to the area’s famed porcupine caribou, potentially threatening their existence (an existence which the native Gwich’in people depend upon for survival), with the Canadian government even issuing a statement in the wake of the ANWR drilling bill reminding the U.S. government of the 1987 bilateral agreement to conserve the caribou and their habitat;

ANWR consists of a biodiversity that’s so unique globally that the opportunity for scientific study is huge, and any development of that land is a threat to that existing natural biodiversity in irreparable way;

The National Academy of Sciences has concluded that once oil and gas infrastructure are built in the Alaskan arctic region, it would be unlikely for that infrastructure to ever be removed or have the land be fully restored, as doing so would be immensely difficult and costly;

Anywhere that oil and gas drilling occurs opens up the threat of further environmental damage from oil spills, such as the recent BP oil leak in the North Slopes of Alaska that was caused by thawing permafrost; and

Not only do the direct effects of drilling for oil in ANWR need to be considered, but also the compounding effects that the eventual burning of that oil must be weighed. The use of the oil contained underground in Alaska will only serve to increase the effects of climate change in the Arctic, where temperatures already rise twice as quickly as the world average. The shores of Alaska are ground zero for the effects of climate change, with melting sea ice and rising sea levels causing additional concerns for survival of both wildlife and human populations that call Alaska home. The most climate-friendly way to treat the oil underneath ANWR would be to leave it in the ground.

Question 5: Can we do better to just install renewable energy resources instead of drilling in ANWR? How much capacity in renewable sources would be needed? How would the costs of renewable installations compare with ANWR drilling?

Part 1: Can we just install renewable energy instead of drilling?

At the crux of the original question was whether the country would be better off if we diverted resources away from ANWR drilling and instead developed comparable renewable energy sources. While this question is rooted in noble intent, the reality of the situation is that it would not always work in practice to swap the energy sources one-for-one.

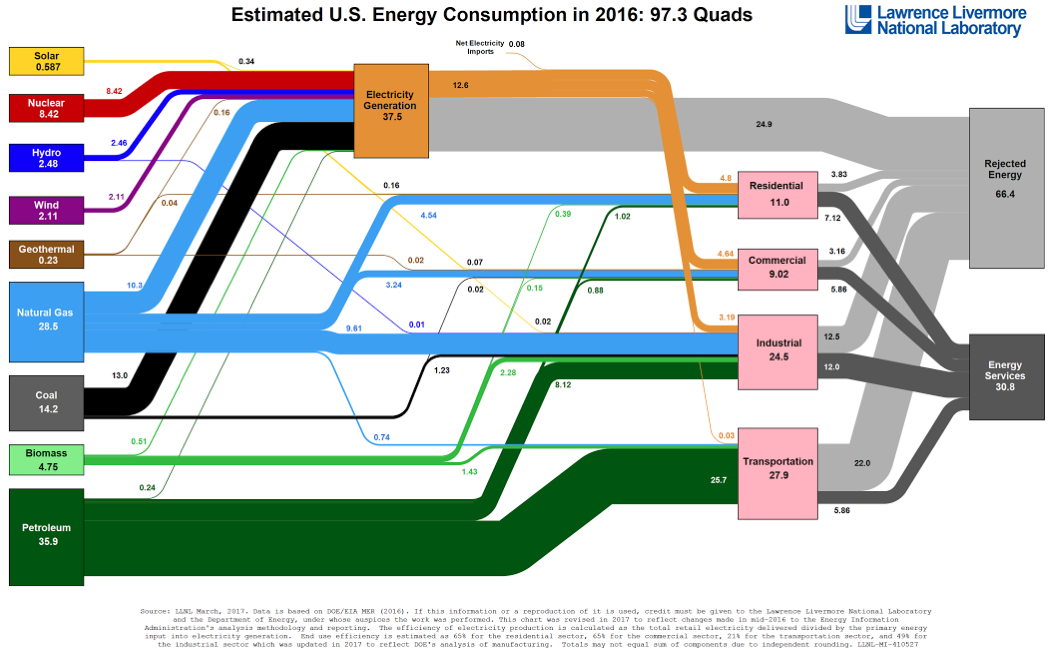

Looking at the way in which petroleum (which includes all oils and liquid fuels derived from oil drilling) was used in the United States in 2016 using the below graphic that is created every year by the Lawrence Livermore National Laboratory (a DOE national lab), we find that 35.9 quadrillion Btus (or quads) of petroleum were consumed. This massive sum of oil energy (more than the total primary energy, regardless of fuel type, consumed by any single country other than the United States and Canada in 2015) is broken down as 25.7 quads (72%) in the transportation sector, 8.12 quads (23%) in the industrial sector, 1.02 quads (3% in the residential sector, 0.88 quads (2%) in the commercial sector, and 0.24 quads (1%) in the electric power sector. Meanwhile, the 28.5 quads of natural gas goes 36% to the electric power sector, 34% to the industrial sector, 16% to the residential sector, 11% to the commercial sector, and 3% to the transportation sector.

Source: LLNL

(side note– I think this is one of the most useful graphics created to understand the U.S. energy landscape every year. I have it printed and hanging at my desk and if you are trying to learn more about the different energy types and relative sizes of the energy sector then I recommend this as a great graphic to always have handy)

Compare this breakdown with some of the non-fossil fuels:

100% of wind power (2.11 quads) goes to the electric power sector;

99% of hydropower (2.48 quads) goes to the electric power sector, with the rest going to the industrial sector;

70% of geothermal power (0.16 quads) goes to the electric power sector, with the rest going to the residential and commercial sectors (using geothermal as a heat source as a direct substitute for the electric power sector); and

58% of solar power (0.34 quads) goes to the electric power sector, while 27% goes to residential sector (in the form of residential solar generation or solar heating, essentially a direct substitute for the electric power sector), 12% goes to the commercial sector (also basically a direct substitute for the electric power sector), and less than 1% goes to the industrial sector.

We see that renewable energy sources are capable of displacing a large chunk of the electric power sector, particularly the types of renewable sources like wind and solar that could be installed in vast open land like the original question asked. However, the oil and gas resources that are the subject of the ANWR debate are largely not powering electricity generation, and as such renewable energy sources cannot easily displace most of the uses of the oil and gas.

The issue with thinking ‘why don’t we not drill and instead just invest in renewable energy’ is that in today’s world, there are lots of uses of energy that can only be served, or at least can only be served optimally, by oil products. For example, renewable fuel replacements for jet fuel are not very promising on a one or two generation timescale and 43% of industrial heating applications require temperatures (above 750 degrees Fahrenheit) that cannot be met by electric means or renewable heating technologies. And regarding the millions of cars on the road, the most pervasive and entrenched oil use in daily life, the looming transition to electric vehicles is taking a long time for a reason– not the least of which is that gasoline’s energy density remains unmatched to deliver power in such a safe, economical, and space-efficient manner. Indeed when analysts or journalists speculate about the world using up all of the oil, what they’re really talking about is the transportation sector because other sectors already largely utilize other fuel types. So when considering where renewable energy can replace fossil fuels, it is important to note that the transportation sector and industrial sector are powered 95% and 72%, respectively, by oil and gas, and that there are sometimes technological, institutional, and infrastructure-related reasons for that that go beyond price and availability.

That said, we are experiencing the eventual shift of some energy uses away from fossil fuels– notably in the transportation sector– but many of these shifts will take time and money to convert infrastructure. Many continue to study and debate whether we’ll be able to convert to 100% renewable energy without the aid of fossil fuels (with some concluding it’s possible, others that it’s not), and if so how far away are we from such an energy landscape. Even considering that it will take 10 years from passing of legislation to beginning of actual ANWR oil production, the American energy mix is only expected to change so much in the next few decades (see the Energy Information Administration forecast for renewable energy, natural gas, and liquid oil fuels below), and for better or worse fossil fuels look to be a part of that mix.

The most significant area in which renewable energy can continue to make headway is the electricity generation sector, the sector that is most suited for renewables even though they only account for 17% of total generation as of 2017. In the meantime, though, fossil fuels like oil and gas will play a crucial role in the energy markets and the potential windfall of resources laying readily underground will continue to be seen as valuable to oil and gas companies (though it is important to ask whether, in the midst of increasing availability of shale oil, will the energy markets need the ANWR oil or will the oil companies even want to gamble on the risky and expensive play).

Part 2: But theoretically, how much renewable energy would need to be installed to account for the energy that would be extracted from ANWR?

All that said, though, for the sake of the academic exercise originally asked, let’s ignore the differences between fuel types and assume that by leaving all the oil and gas from the 1002 Area in the ground and instead installing renewable energy sources (i.e., wind and solar farms) we can extract the same amount of energy for the same needs.

The 2008 DOE report estimated between 1.9 and 4.3 billion barrels of crude oil would be extracted in a developed ANWR. This amount of oil can be converted to between 10.5 and 23.9 quads. The peak extraction according to the DOE report would end up being between 867 and 2,464 gigawatt-hours (GWh) per day.

The 1998 USGS Survey pegged the technically recoverable pegged the technically recoverable natural gas at between 3.48 and 10.02 TCF, which easily converts to between 3.48 and 10.02 quads. Because the DOE report did not break down how much of the technically recoverable natural gas would actually be economical to extract, we’ll assume for simplicity’s sake that it all will be extracted (there’s enough uncertainty in the estimates in all of the USGS and DOE numbers that we need not worry about exactness, but rather make the estimates needed to get an order of magnitude estimate). Without any estimates about the rate of extraction expected from the natural gas, we’ll make a very back-of-the-envelope estimate that it will peak proportionally with oil and reach a maximum rate of 274 to 990 GWh per day.

Adding the cumulative crude oil and natural gas extracted from the 1002 Area would be between 14.0 and 33.9 quads— an amount of energy that would find itself somewhere between the total 2016 U.S. consumption of coal (14.2 quads) and petroleum (35.9 quads). Adding the peak rate of oil and gas extracted from ANWR would imply the total peak of oil plus natural gas of between 1,140 and 3,454 GWh per day (we’re again playing fast and loose with some natural gas assumptions here). This range of rates for the peak energy being pumped into the total U.S. energy supply will be the numbers used to compare with renewable energy rather than the cumulative energy extracted.*

*The reason for this is because it is the best basis of comparison we have to the renewable nature of solar and wind. Why is that? At first glance it would seem that once the cumulative fossil fuels are used up that the installed renewables would then really shine as their fuel is theoretically limitless. However that would be an oversimplification, as every solar panel and wind turbine is made from largely non-renewable sources and the technologies behind them have a limited lifespan (about 25 years for solar panels and 12 to 15 years for wind turbines). As such, every utility-scale renewable energy plant will need replacing in the future, likely repeatedly over the decades. So while the renewable energy sources will not dry up, it is still important to look at the sources from a daily or yearly capacity basis instead of cumulative energy production. Additionally, energy (whether oil or renewable energy) is not extracted and transported all at once, that process takes time. Because of this, energy markets center around the rate of energy delivery and not the cumulative energy delivery.

So given our target range of 1,140 to 3,454 GWh/day, how much solar or wind would need to be installed?

Solar

The reader who asked this question comes from prime solar power territory, so let’s start there. In 2013, the National Renewable Energy Laboratory (NREL) released a report on how much land was used by solar power plants across the United States. With regards to the total area (meaning not just the solar panels but all of the required equipment, buildings, etc.), the generation-weighted average land use was between 2.8 and 5.3 acres per GWh per year, depending on the type of solar technology used. Using the most land-efficient technology (2.8 acres per GWh per year using increasingly common technology that tilts the solar panels to track the sun throughout the day), this amount of solar power would require about 1,166,000 to 3,530,000 acres, or about 4,700 to 14,300 square kilometers, of land.

Source: PV Tech

For reference, in the sun-bathed state of New Mexico, the largest city by land area is Albuquerque at 469 square kilometers. Given that, to equal peak potential oil output from the 1002 Area of ANWR would required solar power plant installations with land area about 10 to 30 times greater than Albuquerque. With the whole state of New Mexico totaling 314,258 square kilometers, the amount of land required for solar installations would be between 2 to 5% of New Mexico’s entire land area (put another way, the lower end of the land-requirement range is the size of Rhode Island and the upper end of the land-requirement range is the size of Connecticut).

Wind

Wind energy is set to take over as the number one American source of renewable energy by the end of 2019, a trend that is likely to continue in the future. One reason for the increasing capacity of U.S. wind power in the electric power sector is its ability to be installed both on land and in the water (i.e., onshore wind and offshore wind). Depending on whether the wind power installed is onshore or offshore, the efficiency, cost, and land-use requirements will vary.

NREL also conducted studies of the land-use requirements of wind energy. For both onshore and offshore wind installations, based on the existing wind projects studied, the wind power generating capacity per area (i.e., the capacity density) comes out to an average of 3.0 megawatts (MW) per square kilometer. As with the solar power land-use requirements, note that this figure goes beyond the theoretical space required by physics but includes all required equipment and land-use averaged across all projects.

Source: New York Times

Operating at 100% capacity, that 3.0 MW per square kilometer would translate to 72 megatwatt-hours (MWh) produced per square kilometer each day. However utility scale wind power does not operate anywhere near 100% due to the prevalence of low wind speeds and changing directionality of winds, among other reasons. NREL’s Transparent Cost Database indicates that offshore wind operates at a median capacity factor of 43.00%, while onshore wind operates at a median of 40.35% capacity. Accounting for these figures, the land use of offshore wind energy comes out to 31.0 MWh per square kilometer per day, with onshore wind energy averaging 29.1 MWh per square kilometer per day. To reach the 1,140 and 3,454 GWh per day from peak-ANWR-oil would thus require about 33,000 to 100,000 square kilometers of area for offshore wind energy and about 35,000 to 107,000 square kilometers of land for onshore wind energy.

Using the same references points as with solar, wind energy resources would require an area roughly between 71 to 228 times the size of Albuquerque, between 11 and 34% the size of New Mexico, or a land-use requirement between the sizes of Maryland and Kentucky. It might seem jarring to realize just how much more land would be required for wind energy than solar energy, but multiple papers appear to support the notion that total land needed for utility-scale wind energy requires as much as six to eight times more land area than utility-scale solar energy on average. Indeed, the land-use required by renewable sources is one of the biggest costs of the energy at this time. If we’re willing to accept nuclear power as a source of clean, though not renewable, energy, then the technology currently outperforms them all by leaps and bounds– requiring 7 to 12 times less land than the same amount of solar power. But obviously nuclear power comes with its own set of political and environmental challenges, furthering the sentiment that there is not one and only one energy that will ever check all of the boxes and meet all of our needs.

Part 3: How would the costs of that scale of renewable energy sources compare with the previously discussed costs of drilling in ANWR?

Considering these results for the amount of land required by solar or wind energy resource to equal the peak oil and gas output of drilling in ANWR, the true scale of the potential energy resources underground the Alaska region really becomes clear. Further, it becomes clear just how difficult it would be to offset all of that potential energy by building utility-scale renewable energy generation. But the remaining question is how would the costs (both financial and environmental) of drilling in ANWR compare with the costs of the same capacity of renewable energy generation?

Source: Union of Concerned Scientists

Economically, the government (both state and federal) is only set to really profit from the drilling in ANWR because the area is government-owned and the money paid by the oil companies to lease the land for oil exploration would go directly to the government and because the government would also take a royalty on the profits made from said oil (a method to raise revenue also looking to be repeated in the sale of offshore drilling in almost all U.S. coastal waters). So while there will always be some degree of money provided to the government from renewable energy sources (e.g, through taxes), the land being used for our hypothetical vast solar or wind farms must come from the sale of government-owned land to provide the same sort of government revenue injection as drilling in ANWR. With wind power, at least, federally leasing for offshore wind farming has started to become somewhat common, though from 2013 to 2016 that only generated $16 million for the leasing of more than one million acres.

In terms of the noted benefits of helping U.S. energy trade by reducing the amount of oil that would need to be imported, the same can be said for a comparable amount of renewable energy– if that renewable energy is offsetting the import of fossil fuels, say for the electric power sector, then an equal effect on U.S. energy trade would be achieved.

In terms of the rough cost to install that amount of renewable energy, we can estimate total costs based on the levelized costs of energy (LCOE), which compares different methods of electricity generation based on costs to build, maintain, and fuel the plant over the lifetime. If we ignore the economic benefits that renewable energy sources enjoy from tax credits, the regionally-weighted LCOE’s of solar and wind power generation sources entering service in 2022 are 73.7 cents per MWh and 55.8 cents per MWh, respectively (compared with 96.2 cents per MWh for nuclear and 53.8 to 100.7 cents per MWh for natural gas, depending on the type of technology used). Compared with the total ANWR costs to extract of $123 billion to reach the 14.0 and 33.9 quads equivalent, the cost for solar would be between $3.0 billion and $7.3 billion and the cost for wind would be between $2.3 billion and $5.5 billion (again emphasizing the uncertainty in how much oil/gas is actually under ANWR as well as the very rough-estimate nature of these cost estimates). These numbers are just for the generation, not to mention the cost for transmission and distribution. However, with state-of-the-art renewable energy technology, it’s important to note that the costs are constantly decreasing and these estimates ignored the current tax credits allotted for renewable energy installations.

While renewable energy sources are seen as more environmentally friendly due to being carbon neutral, there are some environmental effects that cannot be ignored. Any energy source that takes up land is potentially displacing wildlife and using water and other resources. Further, just because the energy source is carbon neutral does not mean that the manufacturing, materials transportation, installation, or maintenance of those renewable plants are without emissions. Solar cells are also known to use some hazardous materials in their manufacturing. Regarding wind energy, extensive studies have had to be conducted on the danger wind turbines pose to birds, bats, and marine wildlife, though largely the conclusions of those studies has been that the impacts to such wildlife is low. Large wind turbines have also caused some concerns of public health regarding their sound and visual impact, but careful siting and planning is able to mitigate these concerns. So while the environmental effects of these renewable source are not nonexistent, they do appear to be much more manageable and avoidable than those of drilling for oil and gas.

Source: Business Insider

Conclusion

Even with the caveat that’s necessary to repeat throughout this post that all the numbers and calculations this analysis is based on are best-guess estimates and averages, much can be gleaned from looking at the results all together. Especially when you consider that the technologies involved for all discussed energy sources are constantly improving and each can be optimized for a particular region (such as using solar energy in lieu of wind energy in particularly sunny areas), the answer of how to best answer the energy future questions of the United States and the world is always going to be a strong mix of energy sources. There is no silver bullet, even among renewable energy resources, but rather heavy doses of appropriate renewable energy sources and nuclear energy sources will need to be mixed with the responsible use of fossil fuels for immediately visible future. Since the United States is quite unlikely to go cold turkey on fossil fuels overnight, the continued supply of crude oil products is going to be necessary for the time being. And the potential costs of largely relying on foreign imports to meet that demand are going to be feared by government and industry leaders alike. As such, it can be of no surprise that the massive resources of oil and gas underneath ANWR have been a continued focus of politicians and the oil industry for decades. However, none of that is to dismiss the legitimate environmental concerns the opponents have with sacrificing one of the last true areas of untouched wilderness in the United States to the predominantly-financial-based goals of drilling proponents, and if indeed the U.S. oil markets can prosper without drilling then that needs to be seriously considered.

The debate of whether or not to drill in ANWR is surrounded with so much uncertainty, along with passion on both sides. Because of this, the answer of what to do is not clear cut to many. The best thing you can do is educate yourself on the issues (I highly recommend a thorough read of the links in the ‘sources and additional reading’ section, as so much has been written about this topic that there is an unbelievable amount of information to learn) and stay informed as it evolves. Like it or not, drilling in ANWR is an inherently political debate and that affords all U.S. citizens the right, even the duty, to take your informed opinion and be active with it– call your Congressional representatives, join in the debate, donate to action groups. While the opening ANWR land for leasing to oil companies in the recently passed tax bill was the most significant action in this policy debate in years, the lengthy nature of the legislature and leasing process assures that the matter is anything but settled.

If you enjoyed this post and you would like to get the newest posts from the Chester Energy and Policy blog delivered straight to your inbox, please consider subscribing today.

For some additional takes on energy policy decisions proposed by the Trump administration, please see other blog posts on the policy decisions of EPA administrator Pruitt, the push for ‘clean coal,’ and the decision to sell off large portions of the Strategic Petroleum Reserve.

Sources and additional reading

A Comparison: Land Use by Energy Source: Entergy

Alaska National Interest Lands Conservation Act: Wilderness.net

“America’s Serengeti” Faces Unprecedented Congressional Threat: NRDC

Arctic National Wildlife Refuge 101: Center for American Progress

Arctic Refuge Has Lots of Wildlife– Oil, Maybe Not So Much: National Geographic

Arctic is Warming Twice as Fast as World Average: NPR

Assessment Overview: U.S. Geological Survey

Canada Sees ANWR Drilling Threat to Border-Crossing Caribou: Roll Call

Congress moves to ‘drill, baby, drill’ in Alaska’s ANWR. Here’s what you should know: USA Today

Cumulative Oil Production on the North Slope

Energy Flow Charts: Lawrence Livermore National Laboratory

Environmental Impacts of Solar Power: Union of Concerned Scientists

Environmental Impacts of Wind Power: Union of Concerned Scientists

Flying Without Fossil Fuels: The Need for High Energy Density: The Energy Collective

Heating and Cooling Efficiency of Geothermal Heat Pumps: Department of Energy

How Much Land Does Solar, Wind and Nuclear Energy Require? The Energy Collective

Northern Alaska, Rich in Wildlife and Oil: American Museum of Natural History

Renewable energy– not always sustainable: Phys.org

Renewables and Carbon Dioxide Emissions: Energy Information Administration

Short-Term Energy Outlook Crude Oil Production: Energy Information Administration

Test Well in Arctic Wildlife Refuge Keeps Its Secret: Los Angeles Times

The benefits of opening Alaska’s ANWR reserve wouldn’t pay for the costs: The Hill

Transparent Cost Database: National Renewable Energy Laboratory

U.S. Crude Oil and Natural Gas Proved Reserves, Year-end 2015: Energy Information Administration